In this blog, we will discuss the effects of fraud and what your small business can do to prevent it.

In business, we expect the best from people and want to trust them. Unfortunately, people don’t always live up to our expectations. If you own or manage a small business, you probably already know this sad truth. What’s more, you most likely know how harmful it can be if an employee can’t be trusted or takes advantage of you.

Fraud hurts your bottom line, slows productivity, and drains valuable resources that could be better used elsewhere. It comes in many forms, from an employee skimming cash from the register to pretending to be injured at work. So, what can you do about it? Here’s what you need to know.

Dealing With Fraud on the Job

It is critical to have a robust set of internal controls in place to prevent incidents before they have an opportunity to disrupt your operations.

For example, one of the most important steps you can take is to keep a close watch on your cash receipts. You must ensure that all cash received is immediately deposited and recorded daily. This should include any petty cash you have on hand. Make sure you require receipts for any disbursements of these funds and reconcile the amount before you replenish them.

Any checks you send also need to be watched closely. This includes reviewing all canceled checks to verify that they have been issued only to recognized vendors and signed by the appropriate people within your company. Any voided checks need to be defaced to prevent them from being tampered with, and your blank checks must be constantly kept under lock and key. In today’s world, many payments are electronically based or handled by dedicated payment applications, the proper checks and balances must be implemented as part of this workflow.

As a smaller business, you’re more vulnerable to fraud than you might think. Being proactive and establishing proper procedures can do a lot to keep you safe from bad actors within your organization. To learn more, take a look at the accompanying resource.

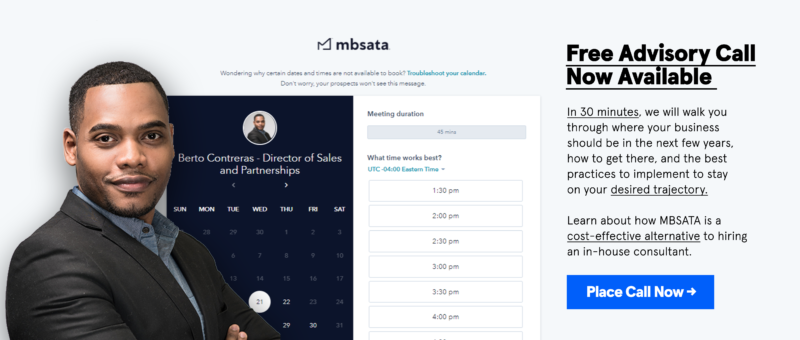

For information on how MBSATA can help you in the fight against business fraud, please email info@mbsata.com