Small Business Bookkeeper Cost

![]()

![]()

![]()

![]()

![]()

Small business bookkeeper cost analysis, what makes up these services, as well as providing ways to reduce costs to your business.

Small Business Bookkeeper Cost Dilemma

Small business bookkeeper cost is a budget line item that many entrepreneurs dread seeing for their business. This dread isn’t fueled by a lack of need for the service but by the price that is commonly associated with it. Small business bookkeeping costs can be extremely cost prohibitive, especially for companies with irregular cash flow. Business owners often might forgo hiring a bookkeeper and pass the work onto themselves; it is not recommended. Most business owners aren’t experienced enough in accounting to take on the work of a bookkeeper, putting them at risk of an audit on their business.

Suppose a small business bookkeeper puts too much pressure on a business’s budget but doing the work yourself is also not recommended. What are the potential solutions to avoiding the reality of high small business bookkeeper costs? First, let’s look at what makes up the service provided in bookkeeping for a small business.

Breakdown of small business bookkeeping costs

The cost of a bookkeeper is entirely dependent on a range of factors, such as experience level, the complexity of the business’s financials, required hours, etc. It leaves an extensive range that a small business could pay for bookkeeping services. Let’s consider what could increase the pricing of your business’s bookkeeping.

Full-time bookkeeper

Some businesses have complicated enough financials that bringing in a bookkeeper full-time is the most responsible decision, increasing your business’s annual costs. The average bookkeeper’s yearly salary ranges from 37,000-47,000 (according to salary.com), and on top of that salary, you will need to factor in benefits such as healthcare, dental, and disability insurance. These benefits usually cost around 30 percent of an employee’s annual salary, meaning that at the high end of average costs per year, a full-time bookkeeper could run you over 65,000 dollars.

Bookkeeper vs. CPA vs. Accountant

The tasks a bookkeeper performs for a business can be pretty rudimentary financial tasks daily. These tasks include things such as invoicing, data entry, and reconciliations. What can increase your small business bookkeeper cost is when your business needs to start expanding outside the realm of the average bookkeeper. Maybe you need someone with high-level accounting skills on top of bookkeeping, or perhaps you need the illustrious CPA letters next to the title of the person you’re working with. These skills and certifications take time and effort from the bookkeeper, and you will pay more to have them at your service.

Necessary Software

The days of books and ledgers are gone. Now we have cloud software and task automation. While services like Quickbooks, Xero, and Sage simplify the bookkeeping process, that simplification comes at a price. In most cases, the client of a bookkeeper will have to fork up the extra expenditure of making an account with the related service your bookkeeper uses. On top of purchasing this license, bookkeepers are not uncommon to charge an integration or catch-up fee to get you on track to use the service to its substantial capacity.

Ways to reduce the cost of your bookkeeping

While there is a laundry list of ways to make your bookkeeping cost more expensive, there are also ways to reduce that cost overall. Some of these solutions may require a higher upfront cost, with the cost reduction coming at the end of the year. Still, any good business owner knows that to spend money, you have to make money, and keeping tight books with your business is undoubtedly a way to do that.

More bang for Your buck

One cost-saving method you could use is the “bang for your buck” approach. Many low-budget bookkeepers keep their costs by doing the bare minimum, reducing your audit risk, and keeping you in business compliance. While these minimum tasks are both great ways of keeping your interaction with the IRS to a minimum, they aren’t the most thorough approach to accounting for your business as a whole. That’s where the bang for your buck approach comes in.

Investing more capital earlier in your business could source a team of professionals with high-level accounting experience. How does this save you money? High-level accounting requires an understanding of tax law that surpasses the general knowledge of a bookkeeper and does more than keep you in compliance. This tax law understanding opens the door for more granular analysis of your cash flow, reporting process, and where you can save money through expense categorization and a deeper understanding of your finances. Working with high-level accounting advisors is an investment into your business with a visible return, instead of using a bookkeeper that only keeps your head above the water.

Flat Rate Options

Small business bookkeeper cost is frequently made up of nickel and diming behavior, particularly when hiring a bookkeeper as an independent contractor. Once you source a third-party individual on an hourly wage, you’ll be spending so much time auditing their invoices that you might as well have learned how to bookkeep yourself! That is where flat rate accounting services come into play.

While a flat rate per quarter will undoubtedly be a higher number than a simple hourly rate, it acts as a form of insurance. The price you will pay for your annual bookkeeping services will not change from what was initially agreed upon; with hourly rates, you are accountable for paying your bookkeeper for every misestimated timeline, delay, additional communication, or surprise project in need of their services. That can result in a bill much more significant than initially anticipated and throw your budget out of wack.

Integrate

As I mentioned, the accounting and bookkeeping industry has become increasingly automated over the last decade. Yet, many businesses have been slow on the jump to embracing this new technology. However, those who have embraced it know the significant difference in efficiency these integrations have resulted in. By investing time into implementing integrations and automation for your bookkeeping software, you minimize the necessary hours of work required for a bookkeeper to do their job successfully. It reduces the cost by minimizing the need to hire a full-time employee and cuts the amount spent on hourly wages.

This tactic works specifically for basic bookkeeping practices. Once your company begins to require high-level accounting services, it can be trickier to automate those tasks as the necessary technology has not been developed yet. By automating those simpler tasks, you make room to focus some of your energy on those higher-level accounting practices, creating a more robust and more efficient business.

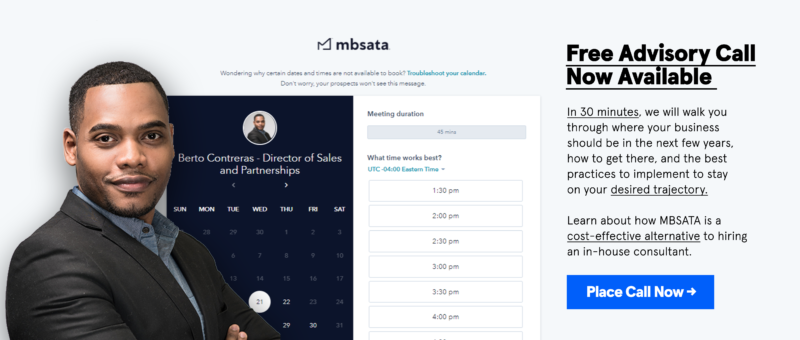

MBSATA is championing the new way companies approach bookkeeping services by ensuring small businesses have access to high-level accounting and business advisory services. We offer flat rates under a value-based model designed to support your business regardless of the situation. Does that sound interesting to you? Let’s chat.

This tax law understanding opens the door for more granular analysis of your cash flow, reporting process, and where you can save money through expense categorization and a deeper understanding of your finances.