Your Audit is Complete – What Now?

This blog will discuss what your organization should do after completing your audit.

It’s finally over. After all the preparation and perhaps even stress, your nonprofit organization’s audit is complete. You can breathe a sigh of relief. However, do not get too comfortable for too long. It is perfectly acceptable to take a breather, although there are steps your organization should take sooner rather than later after your audit is complete.

Read Your Management Letter

Be sure to read your management letter post-audit in detail – the auditors may have found internal controls matters that require immediate addressing. These may come with specific recommendations for improvement.

Remember to consider the management letter’s importance and impact on your organization. It is like getting a study guide with the test answers from the teacher before your quiz. What needs to be done is outlined with solutions to the problems.

The findings can prove to be invaluable to your organization when it comes to its efficiency and effectiveness, as well as the financial benefits that are obtained and streamlined processes and controls.

Closing Meeting

After completing your audit, be sure to meet with your audit firm to discuss the audit process and the ultimate financial statements that were prepared. It is important to know how the process went, as understanding what happened will better prepare you for the next audit; you can use it as a roadmap.

Next, you should discuss with your audit firm the exact findings which may have arisen. The audit is for auditors to confirm that your organization is in good standing of being a “nonprofit” and that funds are being allocated legally. However, you can use the audit to your benefit as well. Auditors can discover much, and having a greater understanding of your organization’s finances will help you make better decisions going down the line.

Make Adjustments and Close the Books

Ensure you book any adjusting entries made by the auditors into your financial software to ensure that your books and records are reconciled to the audit report. After this is complete, close the books so that no changes can be made to the previously audited data.

An organization must constantly adapt to thrive and succeed. Take the findings of the audit and make the necessary adjustments. A significant finding of audits can be missing documents. If you find out that your organization is missing receipts, invoices, etc., this can be used as a wake-up call to put a structure in place to keep tabs on those forms of documentation.

Understand What Changed

If there are adjusting journal entries to the book, review which accounts and line items they affect in your financials: Why did they arise? Look back and reflect on the past year, and ask yourself if some steps or measures can be taken to ensure that there are no adjustments that will have to be made next year.

An audit is just as much a review as it is a reflection. What changed over a year that got your organization to where it is today as opposed to 365 days ago? Did your nonprofit stop following a particular process that is required? Did you not fulfill the requirements that were needed?

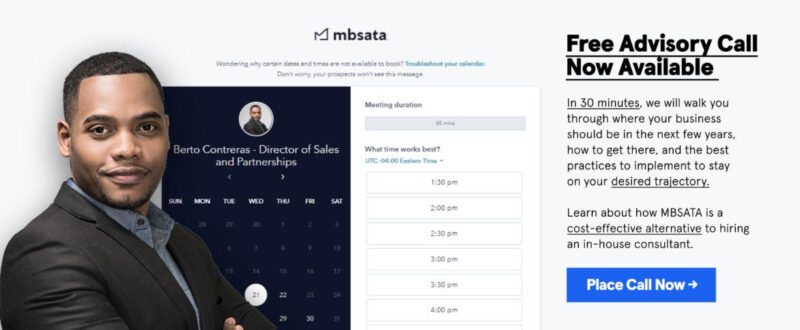

Bring in the Experts

Consider the benefit of bringing in an external, expert accounting and advisory firm for assistance. This will free up time for yourself and your staff to dedicate more attention to your causes and missions. Bringing in an outside firm can also help you save money in the long term, as experts can lay out a plan to follow based on the audit findings that will improve operations across the board. Mistakes can also be made by non-experts which can lead to further complications down the road. Experts will be sure to catch everything and relay information.

When you bring in an outside expert or firm, another set of eyes can look over the audit, and the results yield a much more impartial and outside perspective. Going over what was discovered internally is a great practice and should be done nonetheless. However, having the experts take a look and plan out a guide to get your operations to where it needs to be to get auditors satisfied will go a long way.

It is perfectly normal to want to take a break after the auditing process is over. Nobody would blame you. However, there still is work left to do. The auditing process is not just the auditors reviewing your organization; it is you making the changes that need to be made. Do you have any further questions and what to do now that your audit is complete? Is there anything MBSATA can do for you? Contact us at info@mbsata.com for more information and to have any of your auditing questions answered.

Stay tuned for our next blog on why auditing is a year-long process.