Progress Billing Mistakes to Avoid in Your Business

Progress billing mistakes can make a huge difference in your finances.

Progress billing is a fantastic invoicing method to use as it simplifies the payment process. Being paid periodically is beneficial to both sides and will make any project you embark on have a much clearer focus and stability. However, over the course of any project there is always the chance that hiccups in the system can disrupt the flow of progress.

In this article I will go over the mistakes that must be avoided at all costs, as any of them could prove to be quite disruptive to your operations.

Forgetting to make an invoice, limiting payment options, lack of implementing a late payment policy, and not clarifying charges are the missteps that your business should take extra precautions on in order to prevent them from upending your progress.

Forgetting and Limiting

Running a business is an already difficult task that it can be difficult at times to keep tabs on all of the small details. It is easy to get caught up in the big picture agenda items that something like invoicing can get lost in the shuffle. Set reminders to yourself, reach out to your HR department to give constant notice that you must document all invoices. Find your preferred method to keep you up to date and on track when it comes to ensuring that you do not miss an invoice.

Vendors and consumers make various verbal contracts throughout the course of a project, however, when it comes to your money, this should not be the case. Every dollar that is in your businesses’ name is essential and is not something to be held onto so loosely that not all of your invoices are in writing. Be sure to track, or hire an accounting firm to track, any change orders in contracts or proposals during the duration of a project. Over the course of a project things can change and if you are unaware of them it can spell a recipe for confusion and lead to even further complications.

While a verbal contract works most of the time, it usually is not good enough for your business. Make sure that all possible invoices are documented as it serves as proof for your payment requests and ensures that your client can not dispute it.

When it comes to the actual payments themselves you should be a business that offers numerous methods of doing so. This is usually done through a billing software that can offer a variety of different ways to make payments. However, some businesses depending on the size of the projects accept payments in cash and even through venmo!

Not Having A Late Payment Policy

A late invoice payment can be a brutal blow to your business’ cash flow. Envision a construction company that was going to begin working for a new customer but could not because they received a late payment from a previous client and therefore could not afford to buy the materials needed for the next project. Your business operations stalling is not an option, luckily there is something you can do to keep your clients payments on the right track.

Implementing a late payment policy is what will deter your customers from thinking they have leeway when it comes to giving you the money you are owed. They will be much more on top of fulfilling your invoices when they know there is the threat of being charged for late fees.

Make sure that the policy is clear and precise, leaving no room for questioning or disputing. It must be clear as day and it should work for your business, some may enforce more hefty late fees while others may charge minor ones. You understand your business better than anyone and understand the severity of every situation in which you are paid late, so be sure to consider all factors.

The one thing people never want to mess with is their money, and by enforcing a late payment policy, you are protecting yours. Before starting work on any project, you must make it well known that you have such a policy in place.

Be Very, Very Clear

Over the course of a project there are bound to be unexpected items that pop up that you will need to charge for. One of the worst mistakes your business can make is not clarifying each and every charge. This can be destructive on a multitude of levels.

When you are vague and just add “additional fees,” that gives the client the ability to appeal and dispute those charges. It is basically an invitation for conflict and that will do nothing but impede progress and the flow of your business. It is an absolute must that you write out every possible charge and give clear descriptions of the work you are providing so your client has an understanding of why those charges were necessary.

A great way to prevent this from the very start is to have a conversation with your client before you begin work on the project and go over every charge that you will make that is already set in stone and go over the possible ones you could make along the way. This leaves them with no surprises when your invoices come in.

Another problem when it comes to being too vague in your invoicing is the customer experience angle of it. When customers get hit with surprising payments such as, “additional fees/charges,” it does not sit right with them. They may be inclined not to work with your business again and not recommend your services to others. It is essential that you are open and clear with your clients about the charges that they will have to cover. This provides the best possible experience for them and ensures you get the money you are owed.

Progress billing is an efficient invoicing method that will minimize your payment related issues. Although, we are all human and susceptible to making mistakes and errors. Fortunately, we can learn from others and take the necessary steps needed to prevent them from hindering our own businesses’.

When it comes to progress billing, forgetting to invoice, limiting payment options, having no late payment policy, and not being clear with your chargers are the very preventable mistakes that you and your team should take precautions to avoid. By being on top of these matters, and by doing it consistently, you are putting your business in a good spot to succeed.

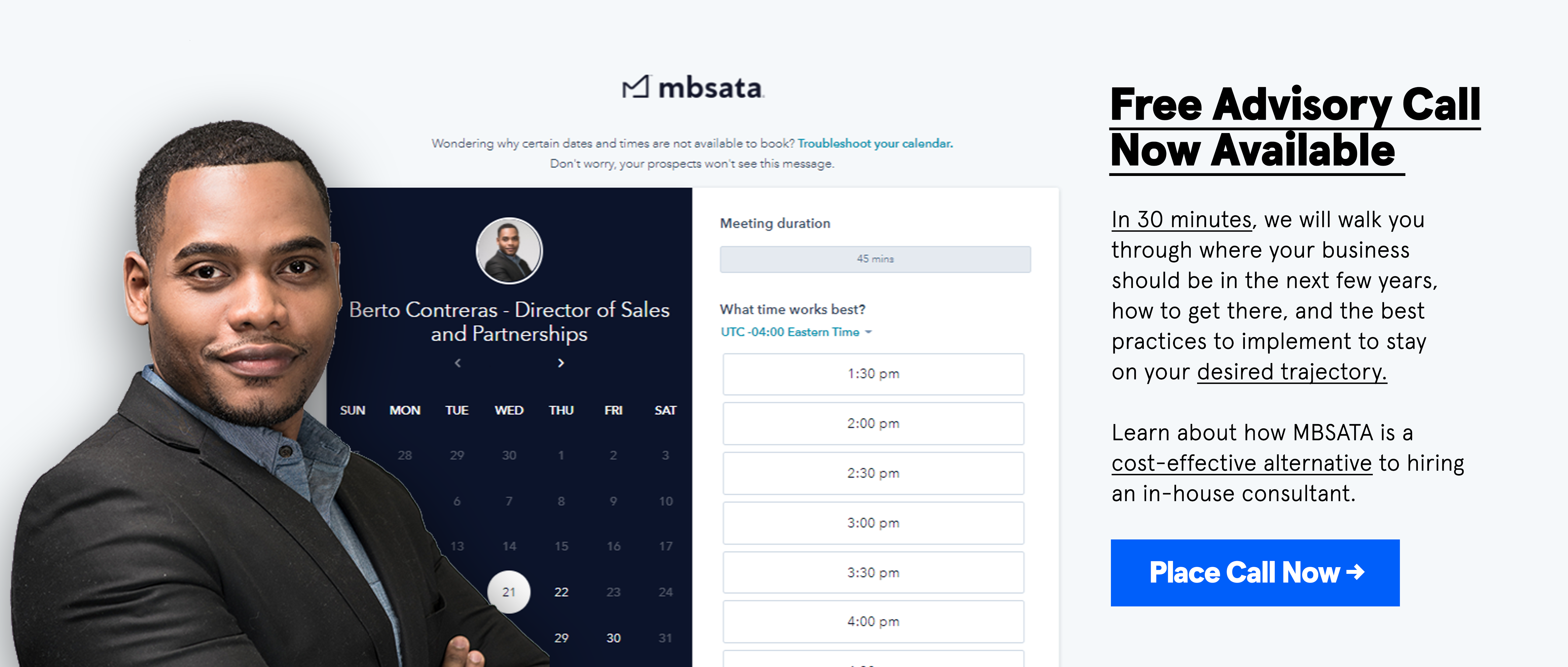

Coming to accounting and advisory firms to seek out expert help is a great way to ensure that these mistakes do not happen in your business. For more information on how MBSATA can work with you to prevent these mishaps from impacting your business, reach out to us via email at info@mbsata.com or give us a call at (212)-243-5757.

Image by DISRUPTIVO